Tax season is here which means it is time for business owners to file their T4 and T4A information returns.

Tax season is here which means it is time for business owners to file their T4 and T4A information returns.

These information returns are due on or before the last day of February, following the calendar year to which the information return applies. If this date falls on a Saturday or Sunday, the information is due the following business day.

This year, your 2016 T4 – Statement of Remuneration Paid and T4A – Statement of Pension, Retirement, Annuity or Other Income information is due on or before Tuesday, February 28th.

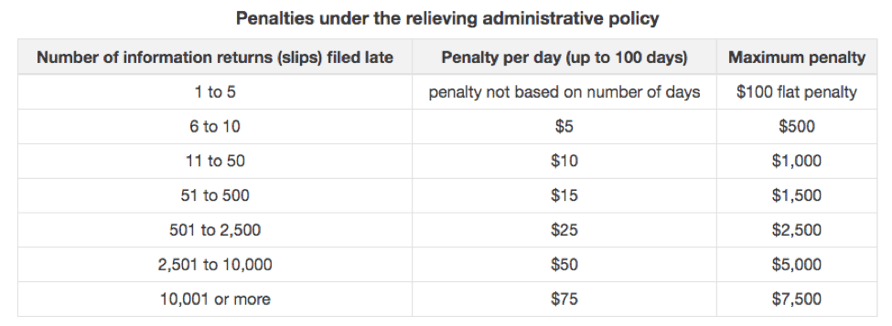

If you fail to file this information by the due date, you will have to pay a late-filing penalty. For certain returns, including the T4 and T4A, the penalty is reduced so that small businesses do not have to pay unreasonable amounts.

This filing penalty will only be applied if the information is received, or post-marked after the due date of February 28th, 2016.

The penalty is assessed on each T4 or T4A information slip and the amount you pay per slip is determined by the total number of information returns that have been filed late.

The late filing penalty for T4 and T4A slips is as follows, according to the CRA website as of January 25, 2017: